Ominously Australian farmers and agricultural businesses are struggling to survive in a market that seems all against them.

Today the Australian Government officially acknowledged Australian farmers are in crisis announcing their Farm Finance package which aims to build the ongoing financial resilience of farmers who are currently struggling with high levels of debt.

Image ABC

As reported by the ABC here Agriculture Minister Joe Ludwig says

“It is important. What we’ll do is boost assistance to farmers because many of them are struggling under acute levels of debt and with the high dollar, depreciation of land values is putting significant pressure on many farmers,” he said.

“When you discuss these issues with parts of the agricultural sector, including the banks, they are experiencing some higher debt pressures out there due to some lower land valuations, lower product prices, and high input costs.

“All of that is making it, right at this time, a little difficult for farmers to continue to compete in some sectors’

The writing has been on the wall for quite some time and the media has been full of bad news stories

This excellent story from the Conversation reflects on what it calls the “farm problem”

Lying at the heart of the crisis facing the WA growers, and impacting on rural enterprise across Australia, is what has been described as the “farm problem”. The problem is caused by the interplay between rising agricultural productivity and the inelastic nature of food demand.

This has led to continual decreases in real farm prices and decreasing returns to farmers. Increasing competition in the food market has meant that any efficiency gains made by producers within their farm businesses are actually captured more by the consumer than the producer.

To counter this trend farm enterprises have sought to expand their area of production, develop new or additional crops or pastures, or grow large via the amalgamation of farms. This has led to the “get big or get out” mindset that has occurred across many of our rural areas in past decades.

However, many farmers lack the financial capacity or the opportunity to expand their business operations. This will result in a few much larger farms and the smaller farms that still exist will generate only minimal income.

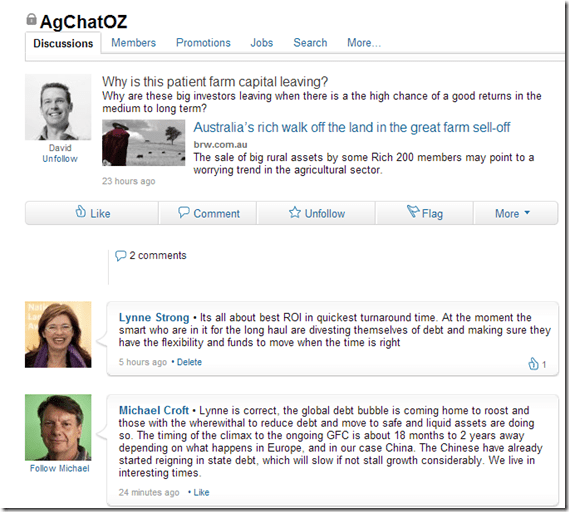

This extracts from a recent article BRW ‘Australia’s rich walk off the land in the great farm sell-off ‘

Farms around the country are struggling and the sale of big assets by some of our richest farmers suggests that more problems may lie ahead for the agriculture.

The big opportunities on offer to feed the fast-growing Asian region are at risk as many farmers – large and small – struggle to pay their bills.

Rural landholders and livestock owners are staples of the BRW Rich 200 but a culmination of factors – including the high Australian dollar and concerns about the viability of the live export trade – are pushing down the value of their businesses.

Many are choosing to sell down their stakes, or have already done so.

‘The idea that the Chinese can come down here and create corporate farms and invest the capital well is nonsense.

“We need people in Australia who understand agriculture, who are able to use that capital well and make money out of it.”

Few are better at doing so than the farmers on the Rich 200, most of whom have long-held interests in major rural assets.

They have a deep understanding of the industry and are better-placed than most competitors to ride out fluctuations in the commodity prices and market conditions.

Rich farmers have been the mainstay of the agricultural industry for decades and their willingness to hold course may be critical if lofty growth targets are to be achieved. If more choose to sell, questions will be raised about whether recent poor conditions are part of a normal cycle or symptomatic of a more fundamental shift in the viability of the agricultural sector.

Maybe just maybe Coles is starting to see the error of its ways but is it too late for the Australian dairy industry as the banks appear to be seeing through the spin. See Financial problems for Tamar Valley dairy

A report in the The Australian says the company has been forced to fund the development of a $20 million yoghurt manufacturing facility after bank lenders refused to provide debt funding to cover the plan.

Tamar is among a handful of dairy processors on whom Coles says it has conferred financial security by awarding them long-term supply contracts — in Tamar’s case, a five-year deal signed last year to supply yoghurt to be sold under its in-house brand.

But analysts including Macquarie Bank’s Greg Dring have questioned whether Coles is paying the processors enough to make an economic return — a view that would appear to be supported by banks’ unwillingness to lend to Tamar despite the apparent income security of the yoghurt contract.

What is this farmer saying? I am with finance reporter Owen Raskiewicz on this one whose recommendation for agricultural stocks are

‘At the moment, it would be wise to steer clear of the industry until it the Australian dollar lowers and trade agreements are revisited. Otherwise your portfolio may end up in a profit drought of its own’.

Sadly I also agree with Julian Krieg

A prominent Wheatbelt financial counsellor has described the current agricultural crisis as a perfect storm and he says in some circumstances it’s time for some farmers to walk away